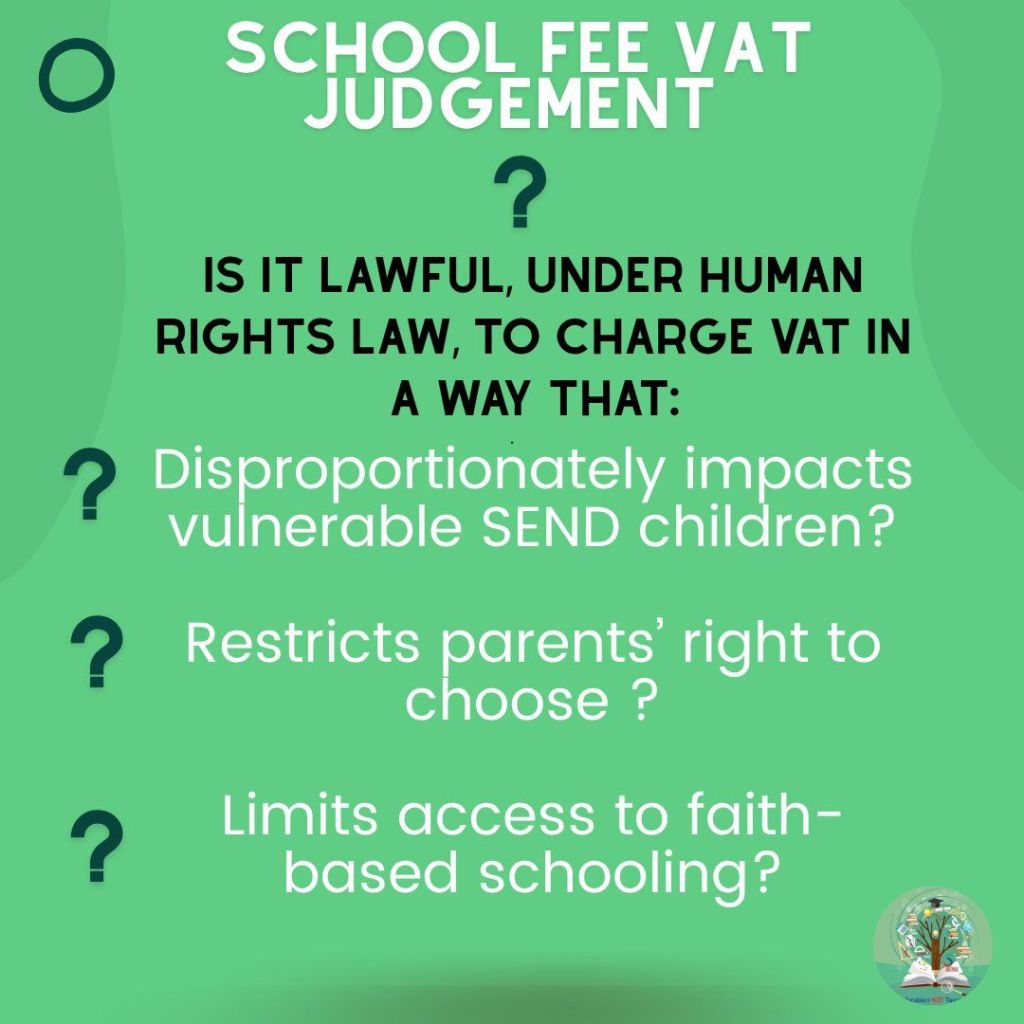

The challenge the High Court judges had to determine is best summarised by the poster statement below; the High Court has concluded that, despite the difficulties the Government’s VAT policy will cause schools and families, it has not breached the Human Rights Act.

I received several statements from the Associations to which we belong. Though the Court recognised that while the policy does engage the claimants’ rights under Article 2 of the First Protocol of the Act, A2P1 (the right to education), it also said that the European Court of Human Rights recognises that states have a broad margin of discretion in this sphere to make a series of policy choices about the organisation of the educational system, some of which are likely to be controversial. As a result, the High Court has dismissed all claims.

Please use the following links to read the judgment:

Summary of the judgment

Full text of the judgment

The Independent Schools Council (ISC) is taking the lead on communications on behalf of the associations. All schools and their membership associations are disappointed with this outcome, not least because of the incredibly intrusive and insensitive introduction of the policy without careful consideration of its longer-term impact on individual families, schools and the nation’s wider education system. Irrespective of the validity of the policy, the government’s

From my position as Principal, in the short term, this decision does clear the way forward and enables us to have certainty for our wider business plans to expand the school’s activities wider into the community. Now we are permitted to rent out our facilities and build wider partnerships with many of our supporting sports clubs, defraying costs whilst at the same time as improving facilities is a win-win. A judgment supporting in part the claimants’ case would inevitably have caused the government to make an appeal, leaving us in limbo for a further 12 months or so. Everything we are doing internally is to review our various needs to bear down on costs whilst retaining the quality and reach of our education provision.

This in no way justifies the current government’s current deeply held conviction that private education should not exist, nor the casual reference to the (apparent) sums of money to be raised from the VAT claimed from our parents. From the initial claims (by the Chancellor) that the money would be used to recruit 6,500 teachers, to fund breakfast clubs in primary schools or now (by the Prime Minister that it will help build new houses for the future, funds paid by working families should be put to the specified use intended, not waved around like a ‘Loadsamoney’ windfall by a latter day Harry Enfield.

The high court judgement calls out the Labour government for using slogans rather than precise, more measured language.

13. The claimants, in their written and oral arguments, submitted that the challenged

provisions have the effect of imposing VAT on educational services, when such

services have never been subject to VAT before. The Government parties, by contrast,

refer throughout to the removing of an exemption or “tax break”. This was, in our view, more a slogan than a legally significant description. We prefer to speak more neutrally

of a “tax change”. The compatibility of this change with Convention rights depends on

its substance, not on any label attached to it for presentational purposes.

Perhaps and most importantly of all, the high court in its judgement has made it as clear as it can that the government cannot ban private education. I quote”

“Does a measure which impedes access to private education engage A2P1 at all?

- At one stage in the oral argument before us, Sir James for the Government parties

submitted that the margin of appreciation accorded to states under A2P1 to choose how to configure their educational systems was wide enough to permit them to prohibit private schools altogether. That submission was, in our judgment, wrong. The Court in Kjeldsen drew attention at [50] to the importance attached by many contracting states

(as apparent from the travaux préparatoires) to the “freedom to establish private schools”. That the right conferred by A2P1 includes such a freedom, subject to regulation by the state, can also be seen from the Commission’s decisions in Jordebø and Verein Gemeinsam Lernen. If it is not within a state’s margin of appreciation to prohibit private schools altogether, a regulatory measure which had the same practical

effect would presumably impair the very essence of the right. We therefore consider that the Government parties were wrong to submit that A2P1 has no relevance at all to measures which affect access to private schools.

Here’s the Guardian’s summary:

“The high court has dismissed a wave of legal challenges against adding VAT to private school fees in the UK, saying the government’s decision was a rare example of Brexit freedoms.

The judges said that adding 20% to private school fees would not have been possible under EU law, stating: “This is therefore one respect in which the UK’s exit from the EU has increased the scope of parliament’s freedom to determine policy.” Other newspapers exist.

For the next few weeks, all in the education sector will have to take stock of what this judgement means, coupled with the spending review announced by the Chancellor on Wednesday 11 June. The full review indicates growing pressure on the delivery of special needs support in the state sector, aligned with a lower than expected investment in Education overall. The good news for Claires Court is that we have the last 4 weeks of term ahead, with a myriad of events and opportunities ahead for both children and adult to collaborate and celebrate the life our school community enjoys when it is in session. There are so many things in life that we can’t control, it’s best we ‘readiate the sunshine’ when we can and enjoy the warmth whilst it’s here.